Calculating the Increased Grocery Tax Credit

The implications of two approaches to tax relief

I am committed to making sure Idahoans aren’t paying taxes on their groceries. Two proposals were put forward this year to achieve this goal: increasing the grocery tax credit, and exempting groceries from sales tax (often referred to as “repeal”). The legislature overwhelmingly chose the first route for the following reasons:

Sales tax is nearly the only way nonresidents contribute to the funding of the infrastructure and services they use when visiting Idaho, and retaining the credit instead of creating an exemption helps maintain revenue from them.

The increased credit options are enough to cover grocery tax for the average family.

In voting to increase the credit this year as part of our three-pronged tax relief package of over $400 million, I believe we have progressed in the right direction, although this has by no means eliminated the need for increased tax relief next year. The following is an overview of this legislation and its implications.

House Bill 231 - Raising the Grocery Credit

On March 5, the Senate passed H231 30-3, which raises the grocery credit Idahoans can claim on their tax returns from $120 to $155 per person, the senior credit also increasing from $140 to $155. Additionally, taxpayers will now be able to itemize their grocery purchases to be refunded up to $250 per person in actual taxes paid. I believe the credit increase, signed into law the week after, is a step in the right direction to provide citizens with comprehensive, long-term tax relief. That said, I greatly respect my colleagues who would have preferred the approach of H260, a personal bill with the concept of exempting groceries from state sales tax altogether. Let’s look at the numbers.

Raising the Credit Ensures Nonresidents Pay for Services They Use

Full repeal would require Idahoans to foot the bill for $24 Million worth of services currently paid for by nonresidents. As the grocery credit is only available to Idaho citizens, the bill we passed this year ensures tax relief is directed only to Idaho citizens rather than to nonresidents.

Legal visitors contribute $18.2 Million in state sales tax on groceries.

According to a Dean Runyan Associates report, “The Economic Impact of Travel in Idaho,” visitors to Idaho spent $304 Million at food stores in 2023. The report’s data compilation method suggests that this category gives a good picture of grocery spending. With Idaho’s 6% sales tax, we may thus estimate that visitors contribute $18.2 Million per year in grocery tax.

Illegals pay $5.8 Million in grocery tax.

Associated Taxpayers of Idaho estimates that, as illegal immigrants pay $72.4 Million in sales tax, they pay about $5.8 Million in grocery tax. This is calculated with the assumption that grocery tax makes up 8% of the sales tax they pay.

If visitors contribute $18.2 Million in grocery tax and illegal immigrants contribute $5.8 Million, repeal could lose Idaho $24 Million in grocery tax revenue from visitors and illegals. This loss in revenue from those who use our resources and services but do not contribute income or property taxes would force Idahoans to provide the funding, which could ultimately have a similar effect as a $24 Million tax increase in the long run.

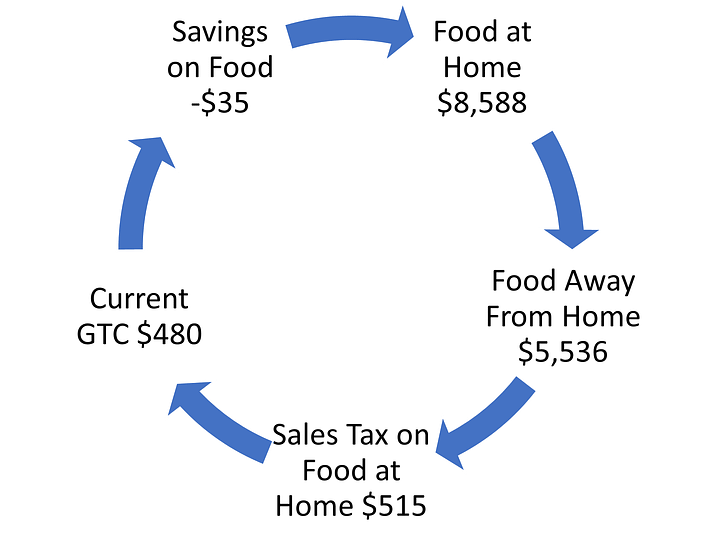

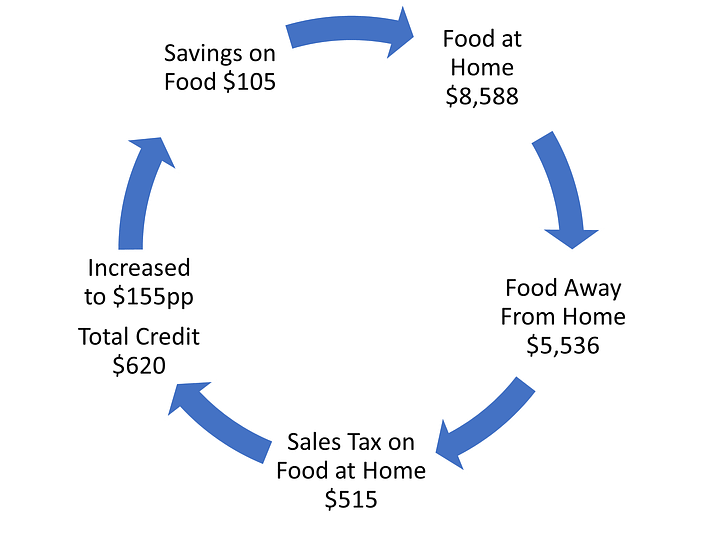

H231 Covers Grocery Tax Liability for Most Families, Based on Estimated Expenditures

ATI estimates that, with the previous tax credit, the average family of 4 has incurred a net loss of $35 annually on grocery taxes, and that, with this month’s passage of H231, they will now have a net gain of $105. These calculations are based on an estimate from BLS data that 8% of an average family’s expenditures are on Food At Home, the category corresponding to groceries. Adjusting existing data for inflation to December 2024 prices, the average family of four (with an annual income after taxes of $128,852 and average annual expenditures of $107,001) would spend about $8,588 on applicable food items, which corresponds to $515 in sales tax. With the previous credit of $120 per person, the family would receive $480 back, resulting in a net loss of $35. With the increased credit of $155 per person, the family would net a gain of $105. Given that many families are receiving more from the credit than they are paying in grocery tax, outright repeal would have a negative impact on a large number of citizens, especially those with lower incomes. These figures do not account for the $250 itemization option, which is provided in case this credit is insufficient. However, these ATI estimates suggest that the increased $155 grocery credit should fully offset grocery tax for most families without needing itemization.

The Total Value of the Increased Credit is Comparable to Total Grocery Tax Revenue

After considering the impact of the credit on a given family, a second method for assessing the sufficiency of the credit involves a broader estimation of tax revenue.

Calculating Total Grocery Tax Revenue: Drawing on Utah’s state revenue data and controlling for factors such as income, a Legislative Services Office report estimates that 12.4% of Idaho’s sales tax revenue comes from the sale of groceries. The same report describes an alternative measurement method using BLS consumer expenditure surveys to estimate that grocery tax accounts for 10.7% of total sales tax revenue. Averaging the results of the two approaches, we may estimate that Idaho’s grocery tax revenue is $407.1 Million.

Calculating the Total Value of the Increased Credit: Using Idaho’s current population of 2.002 million, if we assume the $155 credit will be claimed for everyone, the value of the credit would be $310.3 Million. If every family were able to itemize to $250 per person in grocery taxes, the credit would total $500.5 Million. While it is true that some people, such as those on food stamps, are not eligible for the grocery credit, and that some able to itemize will choose not to, the estimated $407.1 Million in revenue is still solidly within the estimated range for the credit.

This suggests that the total value of the credit approximately covers the amount collected from Idahoans in sales tax, especially when considering that $24 Million of the revenue we estimated comes from non-Idahoans. Any potential gap is further closed because this revenue estimate includes an outsize portion from those who choose to buy more expensive groceries. If taxes on these are not fully covered, it will not be contrary to the legislative intent to relieve affordability concerns.

Other Considerations

Grocery tax credits also have a variety of economic benefits over simple exemptions, such as being less detrimental to economic growth and preserving the budgetary stability generated by sales tax, one of the most consistent sources of revenue especially when compared to income tax. For more worthwhile discussion on this topic, consider this article by the Tax Foundation.

While I understand the desire to do away with the credit and create an exemption, I believe this year’s legislation has advanced us in the right direction, and I will continue to fight for increased relief next year. Regardless of your position on the matter, I hope I have helped you understand more of the factors at play; the better informed we are, the better prepared we will be next year to discuss and seek the most effective ways to keep money in citizens’ pockets.

Please don’t hesitate to email me with any questions or ideas on future tax relief.

In His Service and At Your Service,

Ben Toews

Idaho State Senator – District 4

Very interesting analysis. You brought up some issues we hadn’t considered before.

But, let’s not make it seem that taxes from illegals is a good thing. Illegals they shouldn’t be here at all; hence the term “illegal.” On the other hand, removing the tax altogether would put even more money in their pockets and make the state even more attractive to them.

WOW, complicated stuff! While we opposed the credit, we now agree it’s better than repealing the tax for the reasons you suggested.

Solutions:

Repeal all taxes EXCEPT use taxes (i.e. KEEP sales taxes). That means especially income taxes and property taxes, along with many fees that actually are taxes. In lieu of property taxes, pay one tax one time when a property is purchased and roll it into the purchase price or the mortgage.

Spend only on what is necessary to ensure the proper role of government. Just the basics: roads, water, sewer, and services that are modest and required to support EVERY citizen (no special interests). Do not take federal money with strings attached. Do not put taxpayer money into “nonprofits.”

Of course, the above ideas probably will never fly, but many would consider them a step in the right direction.